A market dominated by an oligopoly…

3 major players administer over 75% of US prescriptions

… Vertically integrated

As if this wasn’t enough, they are owned by, or have merged with, major carriers, and own a Specialty Pharmacies network

Cigna partners with providers via it’s Cigna Collaborative Care program. However, Cigna does not directly own healthcare providers.

Source: Drug Channels, 2021

This oligopoly faces a dual conflict of interests

How did the roles of PBMs transition from processing prescription drug claims to managing health benefits plans

- Owned by insurers, its first strategic priority will be to provide them with the best return on equity these actors expect from them, as Dr. Eric Bricker underscored in one of his recent “Healthcare Finance Video Newsletter” while analyzing these insurers Q2 2021 financial earnings reports. And PBMs have indeed become insurer’s main “profit engine”; during the first quarter of 2022, CIGNA made 75% of its revenue from its drug business. (https://wendellpotter.substack.com/)

- Owning a Specialty Pharmacies network, a second strategic priority will be for them to maximize revenue gained from it

Absent any legal definition, let’s just say that specialty drugs are expensive, used to treat complex conditions, and may require special handling. This complex handling will need to have them distributed via Specialty pharmacies.

Prior authorizations and Step-Therapies « in name only »

Patients and their doctors hate prior authorizations and step therapies, seen as time consuming, sometimes affecting patients’ health.

But PBMs would have different and serious reasons to use them:

- Economic motives, considering the strain these products put on health plans finances;

- Patient’s security issues: since the US Food and Drug Administration established its accelerated approval pathway for drugs in 1992, nearly half (112) of the 253 authorized drugs have not been confirmed as clinically effective, an investigation by The BMJ concluded. (BMJ 2021; 374 doi: https://doi.org/10.1136/bmj.n1898; )

- And when found effective, often these new and very costly drugs have very low efficacy and effectiveness rates (specialists cite a 2% ratio as common!).

While there are real justifications for these methods, too often major PBMs practice “rubber stamped” step therapies, probably because they can’t bring themselves up to forfeit the revenues they get from their specialty pharmacy networks.

ProBleMs with insuline prices

A groundbreaking study published on JAMA November 5, 2021, pieced together data from different states and private sources, and estimated the share of revenues flowing to the different players in the production and distribution channels for 32 insulin products.

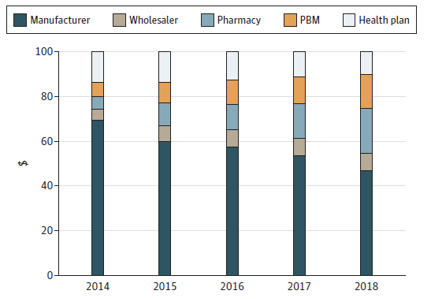

The table below shows the manufacturers’ share of revenues decreased by 33% in 5 years while PBMs and pharmacies substantially increased their piece of the pie: +228% for pharmacies and +154% for PBMs.

All the while insulin prices increased by 40%!

Average Distribution of $100 in Insulin Expenditures for 32 Insulin Products Across Distribution System Participants, 2014-2018

Source: JAMA Health Forum. 2021;2(11):e213409. doi:10.1001/jamahealthforum.2021.3409 (Reprinted

It’s a striking example of how deeply traditional PBMs have failed to their core value proposition to negotiate the best conditions for their clients and how dysfunctional the drug market has become.

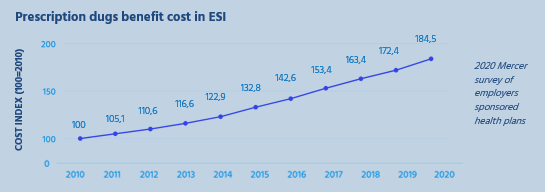

Prescription drug costs have gone up at a high pace in the last ten years

Despite all the rhetoric deployed by these powerful players, the evidence is clear: they have failed in their mission to provide drugs at competitive prices to their customers. Since the PPACA entered in force, prices have risen wildly, especially in the second half of the last decade.

As a consequence, today Americans on average pay their drugs 3 to 5 times more than people in other developed countries, as shown in the graph below!

Source: US House Ways and Means Committee sept.2019 “A bitter pill to swallow”

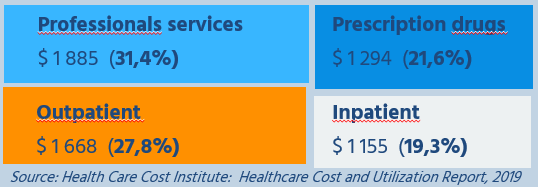

A huge financial burden for plan sponsors and members

Employers now devote over 20% of their health plans’ total spend to drugs. For many employers, especially small ones, that figure can be as high as 30%. And this trend is due to continue if nothing is done.

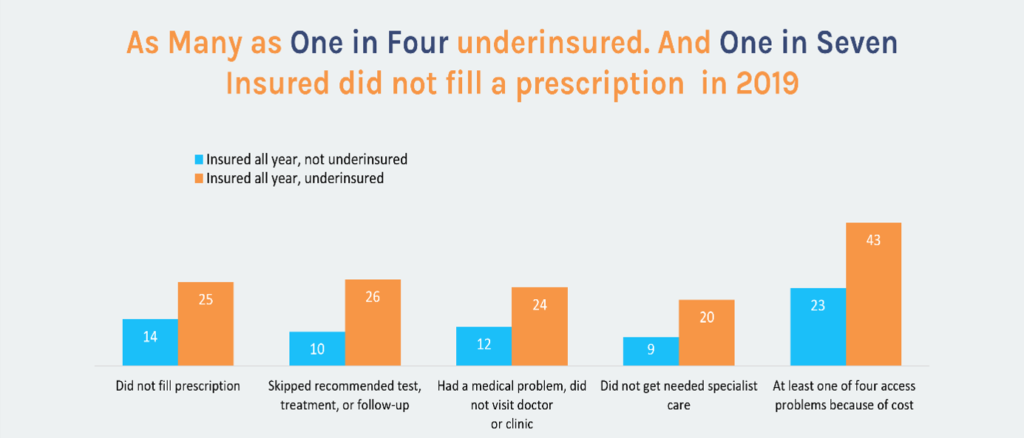

Leaving many without the care they need

Today, many Americans forego their needed care, which represents

a “Ticking Time Bomb”, linked to the issuing deteriation of their health status.

Source: Commonwealth Fund: “biennal study on Health Insurance coverage: a looming crisis in affordability”

Conclusion

Recent developments have shown that there is not much hope on political action to correct these huge market flaws and find remedies to this dire situation.

There is however an opportunity for employers to take action, based on new regulations, such as Transparency in Coverage and the No-surprise Act, and regain control of their health plans.

A new generation of advisers and PBMs is coming to the forefront, with strong ethical values prioritizing the patients and employers’ needs, ready to help them in their endeavor.