- They filed a record number of 312 patent applications thus harvesting a total of 130 patents, 94% of them filed after the FDA’s approval.

- For their worldwide top-selling drug, Abbvie was granted 8 (yes, eight) different orphan drug designations for the same product!

The Drug Pricing Investigation initiated in 2019 by the House Committee on Oversight and Reform had some telling information about some of these practices:

“For example, internal documents show that AbbVie’s R&D investments for Humira focused on “enhancements” to the drug that would protect against biosimilar competition. One internal presentation emphasized that an objective of the “enhancement” strategy was to “raise barriers to competitor ability to replicate.” Another presentation to the board of directors described investments in Humira “enhancement” as a biosimilar “defense strategy.”

Moreover, it has been estimated that by the time Humira faced biosimilar competition, it had garnered nearly $100 billion in sales since the expiration of its primary patents.

The second tactic was signing anti-competitive agreements called “pay for delay” with 9 competitors who had already gotten FDA approval.

Humira represented 40% of AbbVie’s sales in 2021. These record sales were achieved in part due to nearly 30 price increases since its launch, for a combined total of roughly 500%!

Multiple competitors are finally around!

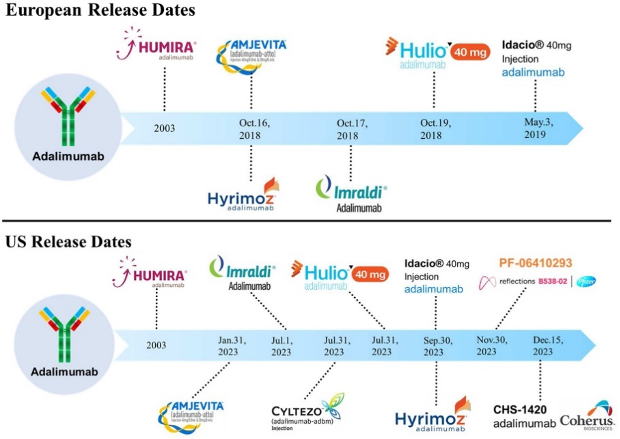

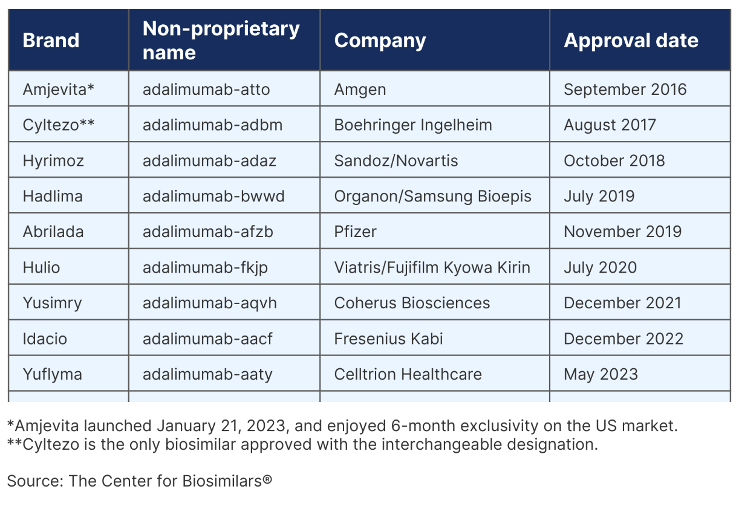

Eventually, 9 competing biosimilar products (see chart) launched in 2023. The first one, Amgen’s Amjevita, received the FDA’s approval in 2016.

It’s worth noting that Abbvie was unable to utilize the same defense strategy in Europe, something the FTC should likely investigate as to why it worked in the US.

This chart is part of a study published in February 2021, and not all of the currently existing products were available at the time

List of Humira Biosimilars in the US as of September 2023

Safety of these biosimilar products

As their name indicates, biosimilars are not exactly the same drugs as the originator product they compete with. Among these Humira biosimilars, only Cyltezo has been approved with the interchangeable designation.

But overall, they showed similar results to adalimumab. All biosimilar switching trials indicated that switching from adalimumab to a biosimilar does not significantly impact efficacy, safety, and immunogenicity

What about Prices?

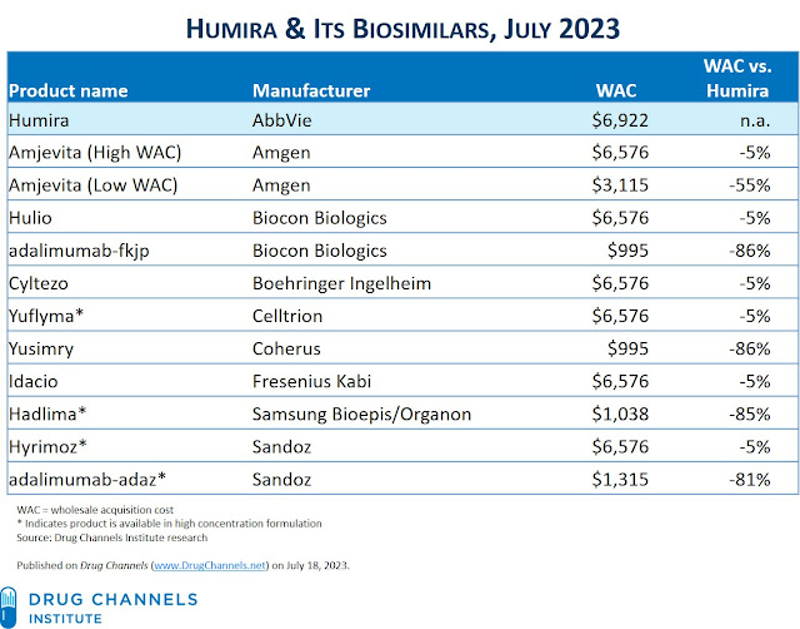

Dr. Adam FEIN, chair of the Drug Channel Institute, dedicated a post to the complex pricing strategies drug manufacturers put in place:

Three manufacturers launched Humira biosimilars with list prices that are only 5% below Humira’s list price, while two have launched products with deep discounts vs. Humira. But Amgen, Biocon Biologics, and Sandoz also launched both high-list and low-list price versions of their products!

This is one of the typical consequences of the complex and dubious role PBMs are playing in the system: pushing for high list prices with large rebates, a solution some large payers seem to prefer (and some of these largest players are their owners or partners…). This will play against the interests of patients who must pay out-of-pocket coinsurance as a percentage of these expensive list prices.

This is why some analysts predict that prices will fall only slightly; observations on other biosimilars show that biosimilars cost 2.74 times more in the US than in Switzerland and 1.94 times more than in Germany.

Adding to the complex issue is the fact that these products are not interchangeable with Humira, doctors could be reluctant to switch patients to biosimilars.

AbbVie said in February that it expected Humira sales to drop 37% overall this year.

Care2Care alternative solution to the cost and security issue

To address this issue, Care2Care is helping patients get their drugs from Canada, and, if accepted by the plan and the patient, from other OECD countries, at prices 50 to 80% lower than in the US. As everyone should now know, these are the same products, sometimes manufactured in the same plants as those distributed in the US, the only difference being the price.

For example, we can securely deliver Humira and Yuflyma to the patient’s mailbox in thermal-engineered boxes with savings of 51% and 57% respectively compared to US lowest benchmark prices.

Ask us for more details and we’ll gladly assist you in any of your pharmacy benefits needs.

As shown in the table above, Care2care International is now able to offer temperature-controlled biologicals, thanks to expedited shipping using engineered thermal boxes and temperature data loggers. This is important and good news for our clients, since many high-cost drugs are cold injectables.