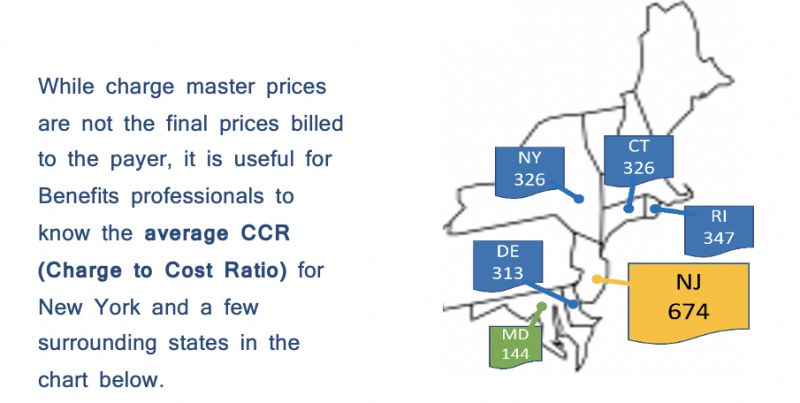

We recommend that you ask your broker, carrier, or plan administrator to check out some of the data providers such as Healthcostlabs ($390 for the complete New York State dataset) to ensure you have a solid pricing benchmark to negotiate

Turquoise Health was also referred to us but did not check their services ourselves.

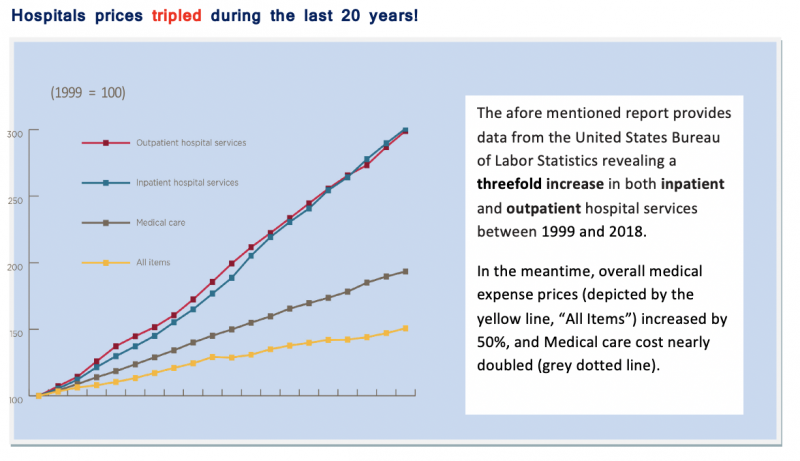

Considering we may have left readers wondering how such gaps in prices, although negotiated by different health plan carriers, were even possible, we dug into the issue and are offering some answers. To do so we used a report published in November 2020 by a national nurses’ union, National Nurses Unites.

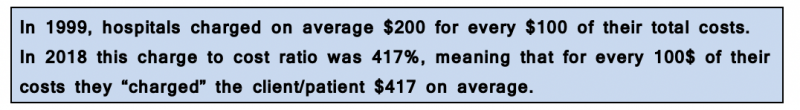

What happened is that hospitals systematically raised the charge master prices. While few if any patient ends up paying the charge master price, it provides a baseline for negotiations between hospitals and health insurance companies over reimbursements (Medicare/CMS does not enter into these negotiations as it sets its rates administratively).

As a direct consequence, hospitals saw their profits increase by an astounding 411% since 1999, from $16.3 billion in 1999 to $83.5 billion in 2018.

Conclusion

As the study shows, these price increases are due to the evolution of hospitals from individually run entities to consolidated multi-facility organizations, mostly for-profit systems, resulting in more concentrated and less competitive hospital markets. Of the top 100 hospitals ranked by CCR, 71 are owned by just two for-profit firms: HCA and Community Health Systems.

While this means negotiation will not be an easy task, given the level of operating profits they enjoy, hospitals still have enormous margins to adjust their prices down. And smaller, more flexible hospitals may be able to provide the same procedures at a significantly lower price.