Finally! Humira’s biosimilars also hit the us market!

Humira was first marketed in 2002 and was protected in the US market until 2023, thanks to AbbVie’s use of two strategies :

A message from PhRMA:

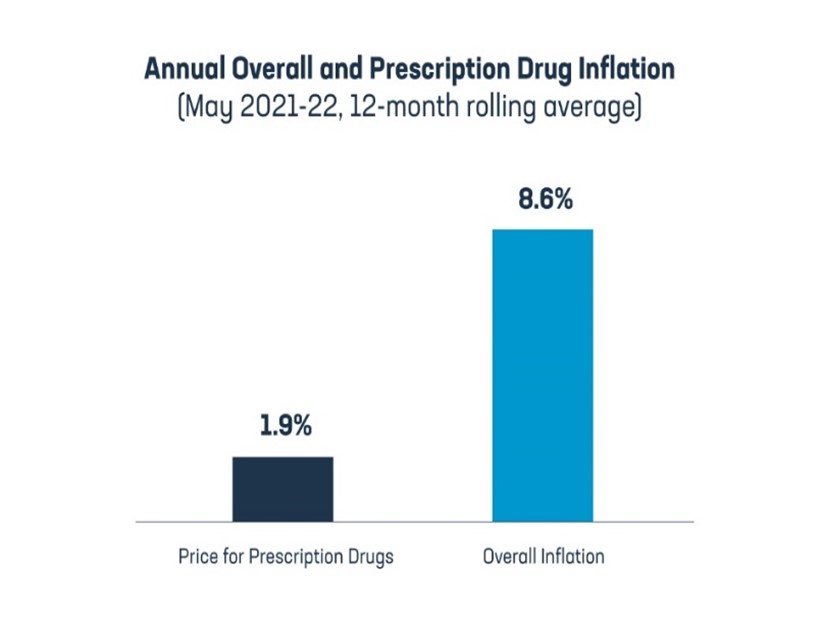

Inflation is causing pain for people across the country. As policymakers search for ways to help provide relief, some are erroneously tying inflation to prescription medicines. To make matters worse, this false premise is being used to build support for harmful policies. It’s important to make medicines affordable for patients, but let’s get a few facts straight – starting with the fact that prescription drugs are not fueling inflation.

This efficient communication is profoundly misleading and misses the point: US drug prices are shockingly high, as patients experience every day. And they are uniquely high, compared to the rest of the developed world.

Source: House Ways and Means Committee Sept. 2019 “A bitter pill to swallow”

The price variation is really stunning: Japanese for example are paying 6.7 times less than Americans! On average, the US are paying nearly 4 times what other, smaller nations are paying.

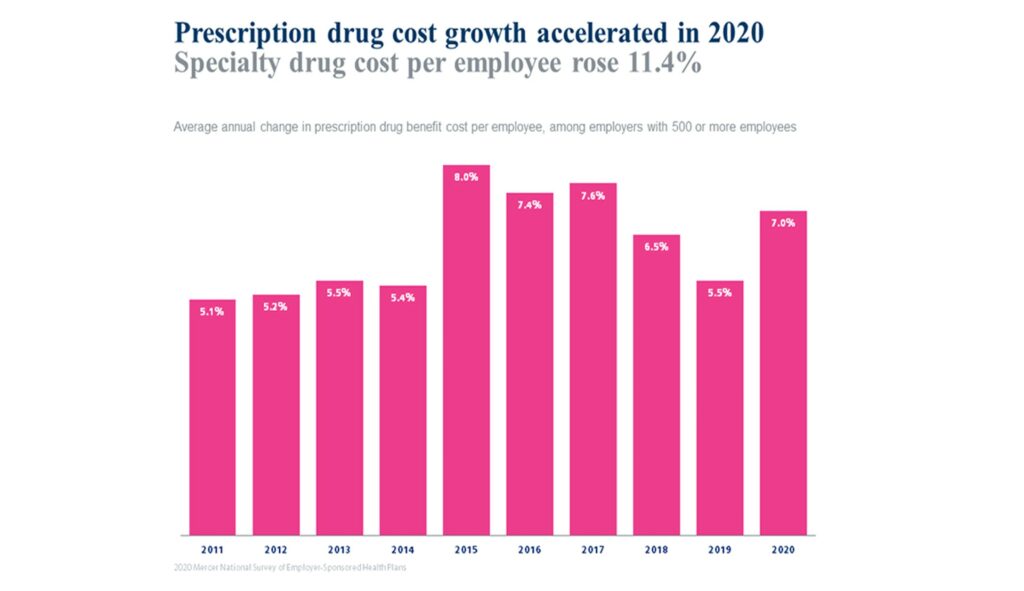

This is also a gross attempt at hiding the enormous price increases of the past decades. According to Mercer, a national health brokerage network, the compounded 2011-2020 growth rate amounted to 85%.

Assuming a modest 3% average price increase for the 2001 to 2010 period, the result is a combined 250% growth of prescription drug prices during the last 20 years!

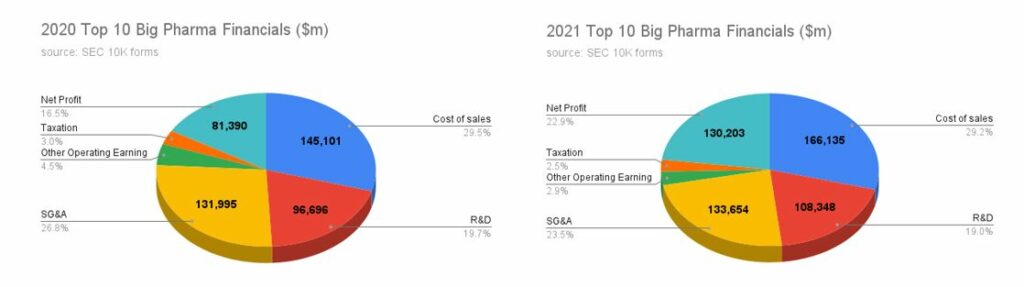

To counter the demands for Congress to lower prices, Big Pharma stubbornly alerts that this would hamper research and development efforts they claim to massively invest in.

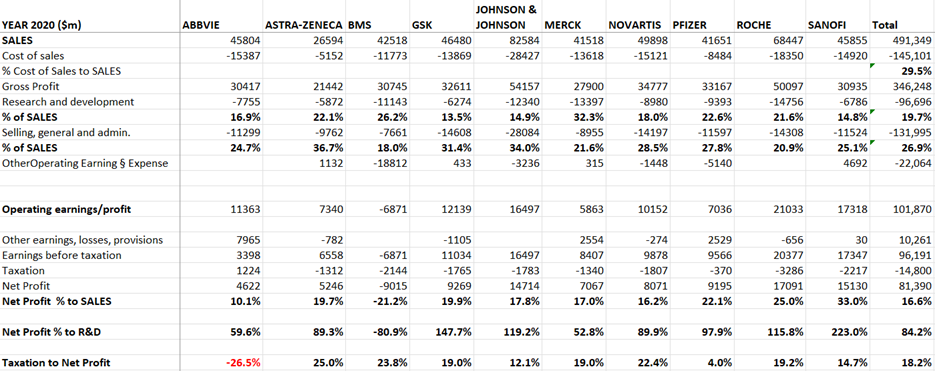

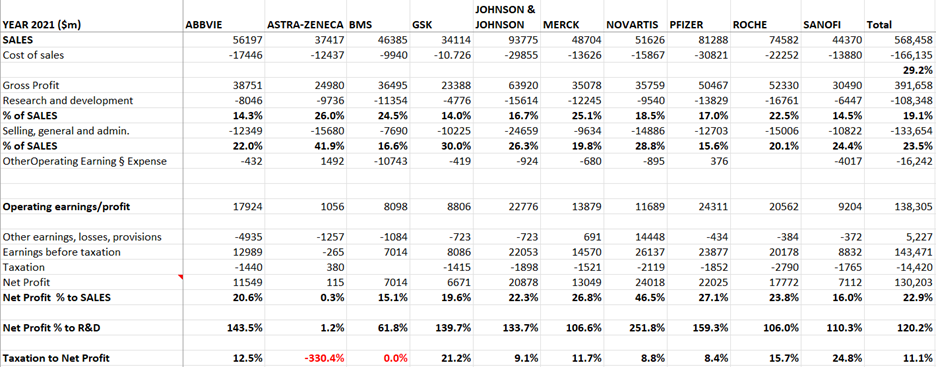

Based on an analysis of their own financial data, we can demonstrate here that:

Our “reality check” is exploring the 2020 and 2021 financial data of the 10 largest publicly listed Pharmaceutical companies, as provided annually to their investors and the SEC (Form 10K, see Appendix A and B). This form discloses 6 key figures:

In 2021, for 8 companies net profit exceeded R&D (special mention for Novartis with a 251% ratio. End June 2022, the company with a headcount of 108,000 detailed plans to cut 8,000 jobs worldwide to be “leaner and simpler”)

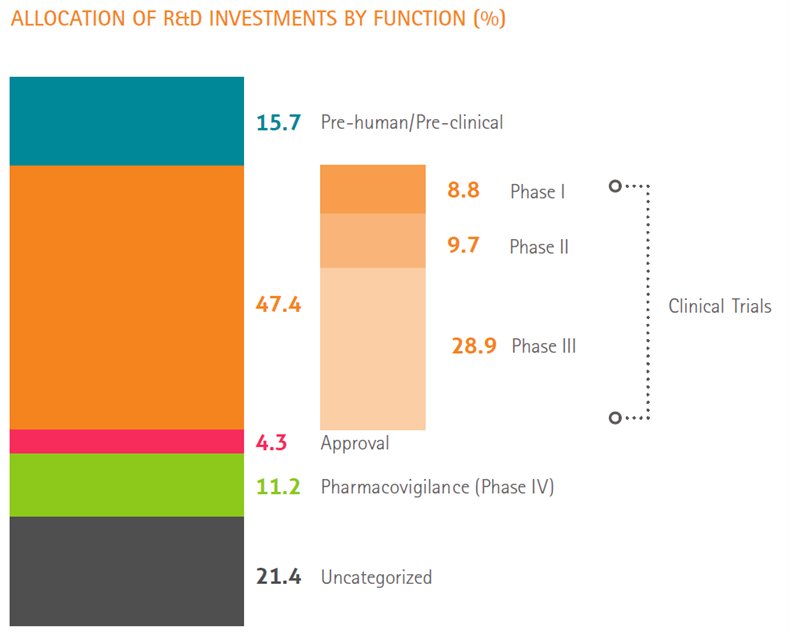

Furthermore, most of this research is devoted to clinical trials.

EFPIA (European Federation of Pharmaceutical Industries and Federations) reports that the pre-clinical/pre-human research conducted by pharmacy companies amounts to only 15.7% of their R&D investments, i.e. about 2.5% of net sales.

Source: The pharmaceutical Industry in Figures Key data-2021, page 8/28, EFPIA

Covid vaccines offered a recent example about this situation: of the 5 existing vaccines (see detail in Appendix C), only one, Janssen/Johnson, has been developed by a the Big Pharma Company itself, and it appears to be the least effective. The other vaccines have been researched and developed by smaller biotech companies partnering with large traditional companies for their ability to run clinical trials and their production capacity, whether in-house or outsourced.

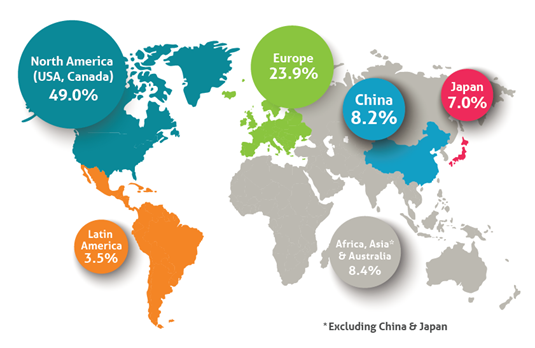

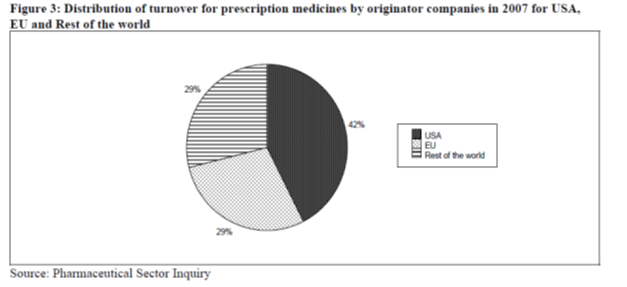

The infographic below illustrates a stunning reality of the pharma market: while the 370 million Americans represents only a little more than 4% of the global population, North America’s drug market represents nearly 50% of the total sales; over twice the market size for the 746 million Europeans (numbers in this study include Russia and Turkey).

Given the access problem many Americans face today, as reported by multiple studies, this can only be explained by the difference in prices and not by consumption which is fairly similar to other countries. “It’s the prices, stupid!” as the late, renowned healthcare expert Uwe Reinhardt wrote 25 years ago.

Source: IQVIA- EFPIA (European Federation of Pharmaceutical Industries and Associations)

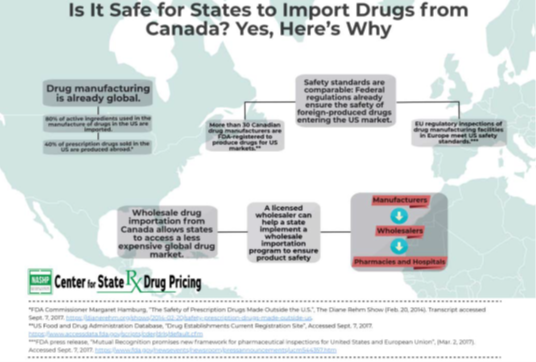

As shown by different research, pharmaceuticals production and supply are global, be it for ingredients or for medicines: China is the main producer of the first category, India of the second. See for instance: Even Drugs Manufactured in America are not “Made in the USA” | PharmacyChecker Blog

In 2017, the United States and the European Union signed an agreement, allowing U.S. and EU regulators to utilize each other’s good manufacturing practice inspections of pharmaceutical manufacturing facilities.

This is an official acknowledgement that each party considers the other one has strong processes in place to ensure that only safe medicines are entering their markets.

But Big Pharma, thanks to its deep pockets, has so far been able to convince many in the American public about the fairy tale of a uniquely secure US market.

Our essential findings do not support Big Pharma’s claim, to say the least: R&D is only the 4th item of a drug company’s balance sheet, often lower than net profit.; and fundamental/pre-clinical research is only a small fraction of it.

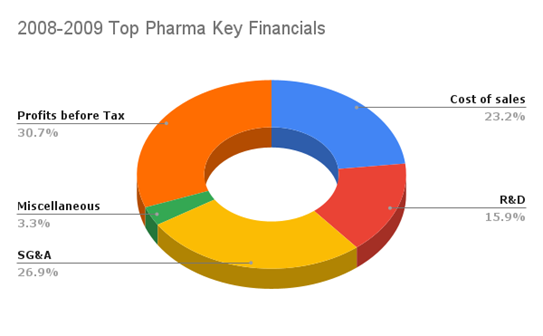

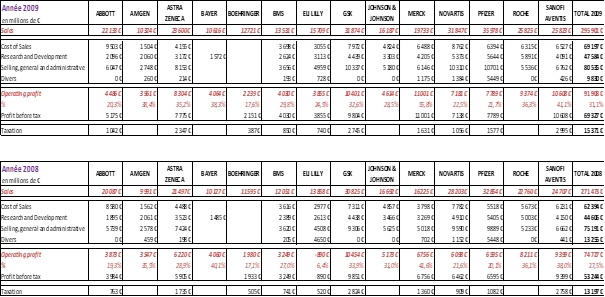

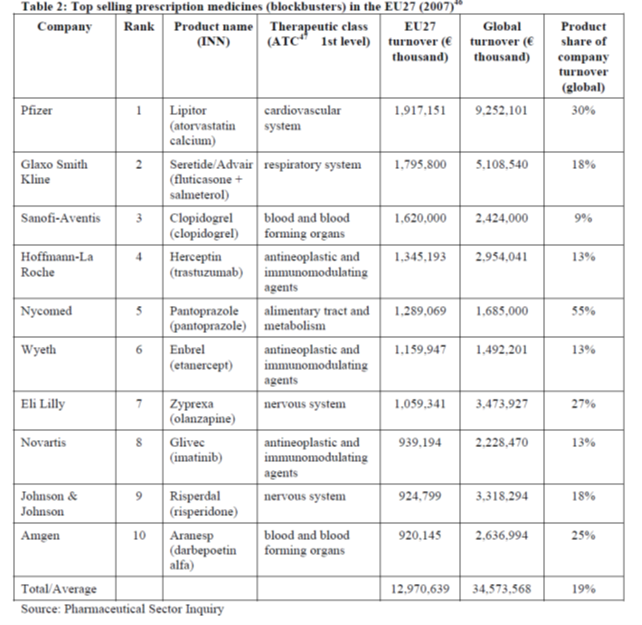

Appendix D features of a European inquiry on the sector, conducted in 2008-2009, whose main findings are very similar. This situation seems to be a permanent feature of the sector.

In the face of these deeply damaging lies, Care2care International considers that using the international market, in secure countries like Canada, the UK or the European Union is a fair proposal to help Americans get their needed medicines and avoid the dangerous situation of medical debts 100 million Americans are nowadays trapped in.

TOP 10 BIG PHARMA SUMMARY FINANCIALS 2020

TOP 10 BIG PHARMA SUMMARY FINANCIALS 2021

THE COVID VACCINES

Their vaccine, Nuvaxovid, was approved in the European Union at the end of 2021 and in Canada in February 2022,[5] as the fifth vaccine against COVID-19, following Pfizer/BioNTech, Moderna, Janssen and AstraZeneca.[

THE EUROPEAN COMMISSION 2008/2009 PHARMACEUTICAL SECTOR INQUIRY

In 2008 the European commission launched a sector inquiry into EU pharmaceuticals markets Under the EC competition rules (Articles 81 and 82 of the EC Treaty), “because information relating to innovative and generic medicines suggested that competition may be restricted or distorted. This was indicated by a decline in innovation measured by the number of novel medicines reaching the market, and instances of delayed market entry of generic medicines, as compared to what might be expected. This report confirms the decline of new chemical entities reaching the market and the delays of generic market entry and highlights some of the possible causes. In this respect, it points to company practices contributing to the phenomena described.”

The 533 pages full report was released July 2009. Its main subject was to elicit the strategies drug companies use to protect their findings via patents, block competition from other companies, delay protection benefiting to their products, etc. In this regard, it’s a real trove of information and the reality described in this document probably endures today.

But the part of the report that gained our attention at the time was the one dedicated to the financial aspects of Big Pharma’s activities.

Page 32 presents data for the year 2007 comparable to what we found in 2020/2021:

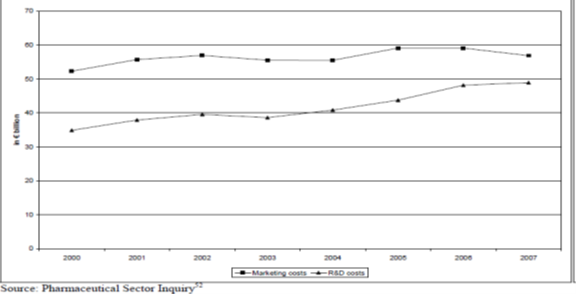

“Between 2000 and 2007 the respondent originator companies spent on average 17% of their turnover generated at global level with prescription medicines on R&D for new or improved prescription medicines. In 2007 approximately 1.5% of global turnover was spent on pre-clinical research – research to identify potential new medicines, the remaining part mostly on clinical trials and tests.”

We decided to build a table for fiscal years 2008 and 2009 retracing financial data from the 14 largest companies at the time. Here are the summary aggregate results and the complete tables:

Another table highlights that the situation where R&D investment is second to Marketing costs is a structural component of Big Pharma’s financials.

Another one, page 27/533 illustrates the abnormal importance of the US market for Big Pharma.

And finally, the report sheds light on the main challenge faced by the industry at that time: the potential loss of patent protection for a large share of its blockbuster products.

Page 29/533 presents a list of the Top 10 selling products, representing in total 22% of their sales in Europe at the time, half of them were about to lose their patent protection between 2008 et 2012.

At the same time, Big Pharma had begun buying tech companies: Roche bought Genentech, Sanofi took control of Genzyme, Pfizer was bought by Wyeth, the resulting company keeping the Pfizer name, and a huge wave of mergers took place.

Finally, and retrospectively, Big Pharma seems to have overcome this perilous period clearly at the expense of the consumer.

Humira was first marketed in 2002 and was protected in the US market until 2023, thanks to AbbVie’s use of two strategies :

After wrapping up the 2023 enrollment, employers are now planning their next moves to mitigate the continuously growing healthcare costs impacting their plans. This is particularly true for pharmacy costs.

100 million Americans, insured or not, are saddled with medical debt, a recent survey by Kaiser Family Foundation established.

Care2Care secured a strategic partnership with an innovative, transparent, 100% pass-through PBM.

Adding to our expertise in international drug sourcing, we expand our offer to the full pharmacy benefit management.